Instructions about home finances

Home Finances

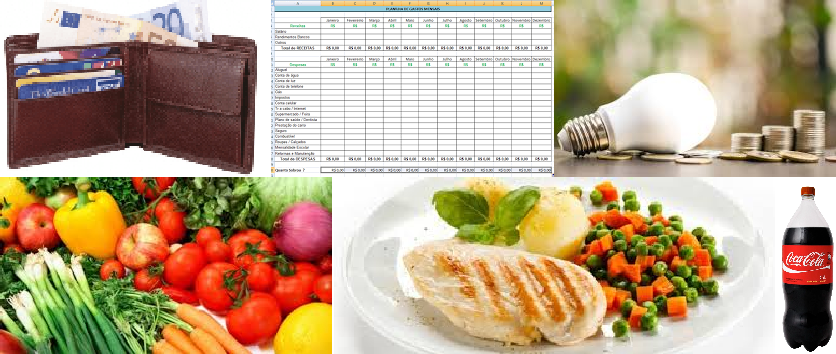

Many problems in marriage are born from financial problems. This can be avoided. OK, there can be a problem because you do not make enough money with your job, or you are out of a job. But let us try to give some tips.

You can only spend your money once. When you have little money to spend, you can only spend to things that are absolutely necessary. You look good for deals. And you remain WITHOUT credit card. The credit card has a high interest rate in the form of annuity and high fine. I never forget the day that I was very busy and the invoice arrived on Tuesday (the bank said it was a postal problem). My due date was last Friday. I need to pay $ 238.00 of fine and interest over three days, due to the weekend days. Yes you pay interest but above that the bank fines you. The amount was only $ 2010.00 to pay. Almost 12% the valour only over 3 days too late in paying. The bank also includes Saturday and Sunday as collection days. Immediately I cancelled my credit card, and I did not listen to all the bank's wonderful promise to get a card with lower rates. Do not be deceived. I used it for 10x purchases.

Look, do not be fooled by 10x interest-free purchases. This does NOT exist. Interest is already included in the price!

Now I have discovered that when I pay cash in the store (in cash, or even with a debit card at high value purchases), you are able to earn a discount of 5-10%. If the manager says no to discounts, check other stores. Yes it can be from the same company in the other neighbourhood. Note this holds true for freight as well. Same company in one neighbourhood calculates freight, in the other neighbourhood freight is free. You can investigate on the internet (for the same or other company). ONLY BUY IN THE WELL-KNOWN COMPANY SHOPS! Not in stores you do not know. Look at the price on the internet and add the freight price. This price can get more expensive than at the store. Compare the prices of several stores.

Never fall in the tramp of use this "use your credit money" advertisement. These companies calculate interest for your cash loan and the bank calculates interest to borrow. So you pay twice (often over a longer period)!

Avoid finance's problems at home

Know your expenses

Knowing your expenses is very important.. You have food expenses. Monthly: rent, energy, water and telephone bills (cell phone as possible you can dispense). Unfortunately many people forget the annual accounts like home taxes and car taxes. But also have other accounts: clothing, shoes, house maintenance (faucet, pot, plugs, painting) and car.

You need to book each month for annual accounts, and transfer this for savings or investments (risky). Examples: Home taxes, car taxes, tuition and your children's books, vacations.

Think well about health plan. I pay less without health insurance, but my family is healthy. Medical costs are very high in the United States. In other countries one is obliged to have an health insurance. Monthly reservation for medical costs. Thanks to God we are healthy, and we spend little on private doctors and medicines. The dentist is less, than with a dentist plan. But the hospitals of the government (in Brazil) are terrible. So look what is best for you.

Note your expenses in a spreadsheet

It is important to know your expenses of the month and per year. So you write all your expenses in the worksheet. Even the expense of a dollar! 30 x 1 dollar is 30 dollars per month! Here's an example.

Take a yearly expense and divide by 12 to know the value per month.

If your gas botle lasts 3 months, for example a bottle of gas costs $ 60 divides by 3 = $ 20.00 per month.

| Date | Expenses | Value in $ |

| 3-May-2017 | Food | 158,24 |

| 8-May-2017 | Icecream | 15,00 |

| 9-May-2017 | Food | 117,26 |

| 14-May-2017 | Food | 58,39 |

| 20-May-2017 | Food | 69,72 |

| 23-May-2017 | Food | 148,12 |

| 27-May-2017 | Food | 67,26 |

| 30-May-2017 | Food | 54,23 |

| 28-May-2017 | Tithe | 300,00 |

| 28-May-2017 | Gifts | 50,00 |

| 28-May-2017 | Energy | 96,25 |

| 28-May-2017 | Water | 51,73 |

| 28-May-2017 | Bottle of water | 16,00 |

| 28-May-2017 | Gas | 20,00 |

| 28-May-2017 | Telephone | 50,56 |

| 28-May-2017 | Mobile phone | 45,76 |

| 28-May-2017 | Rent | 400,00 |

| 28-May-2017 | School | 236,20 |

| 28-May-2017 | School material | 100,00 |

| 28-May-2017 | Home maintenance | 50,00 |

| 28-May-2017 | Home tax | 80,00 |

| 28-May-2017 | Car tax | 75,00 |

| 28-May-2017 | Car maintenance | 60,00 |

| 28-May-2017 | Petrol | 150,00 |

| 28-May-2017 | Birthdays | 30,00 |

| 28-May-2017 | Holidays | 100,00 |

| 28-May-2017 | Clothing | 80,00 |

| 28-May-2017 | Shoes | 55,00 |

| 28-May-2017 | (Health) insurance | 200,00 |

| 28-May-2017 | Makeup | 15,00 |

| 28-May-2017 | Others | 50,28 |

| 28-May-2017 | Total | 3000,00 |

Need to save

Why do you need to save?There are several reasons:

- You have your annual expenses. Better to reserve each month 1/12 of these expenses, than not being able to pay the bill when the anual payment arrives. With savings you receive interest that helps against inflation.

- Save for expenses not monthly like clothing, shoes, maintenance, etc.

- Save for your retirement. Remember that government retirement is just a minimum wage.

- Save for big things (washing machine, stove, TV, etc.). Payment in cash is much cheaper!

How to save?

Savings are safer, but the interest is low. And the interest is only valid if it remains about 30 days at the savings account (there can be a fixed date when you receive your interest).

Investments (in Brazil) is somewhat less secure than saving. The interest can be daily. But one cannot take money the first 30 days after I opening the account. But be very careful, the interest is very low at the moment 2019. In 2019 it does not value to invest, better and saver to have a savings account. Be careful as well, various you have to pay tax over the interest of the investment.

Stocks are at high risk. Do not start with this without you have a person with a lot of experience in this area. Actions are only long-term (minimum 5 years, better 10 years or more) without touching the money. The profit may be high, but the (complete) LOSS can be high as well. For calm, controlled and non-nervous people.